Solving Liquidity Incrementally

Conventional wisdom assumes that investors receive a return premium for bearing an investment that is illiquid. Said differently, when the ability to price an asset is opaque and/or the ability to sell at a moment's notice is a challenge, there is additional risk for bearing the informational darkness and transactional disadvantage.

Illiquidity has been a problem in the traditional art market as well other other asset classes such as private credit and real-estate. And it too remained a challenge within the emerging NFT space.

However, the pace at which the NFT market solved its own problems has been nothing but short of exceptional and is indicative of composability within the Ethereum ecosystem. The progression seemed to follow this:

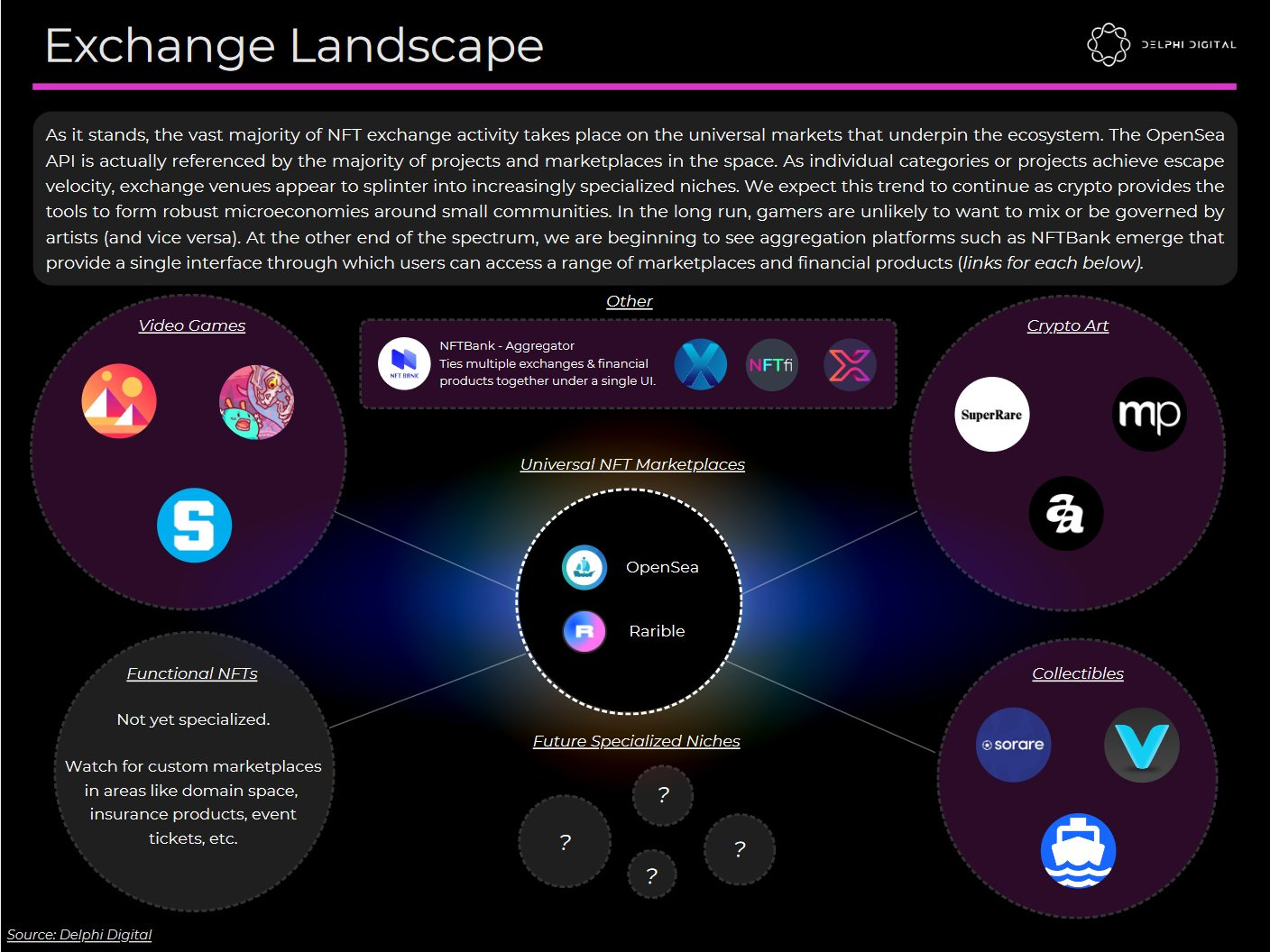

A number of exchanges, such as Rarible and OpenSea, have assuaged NFT investors concerns by creating traditional Web 2.0 / 2.5 auction style markets.

Then, to combat the generalized nature of these one-size-fits-all marketplaces, the market developed specialized exchanges such as $MANA, $SAND, SuperRare, Asynch Art, and others.

And naturally, with the splintering of liquidity, aggregators such as NFTBank looked to query the market-place for their end-users.

While there is still a lot of work to do in these market-places, the net result has been increased liquidity and a stronger UX.

History Rhymes

Nevertheless, these traditional market-places are still ontologically peer-to-peer (p2Peer); users that want to offload NFTs need to find a counterparty to accept their trade.

This design mechanism appeared in DeFi with $AUGUR and $DHARMA and was prohibitively expensive and ignored the long-tail assets.

DeFi also solved its problems with the mass adoption of Maker, where end-users entered into smart-contract covenants (SMC) or, relationally known as peer-to-contract (p2Contract).

And it evolved further with Uniswap, where end-users traded against a pool of assets, known as peer-to-pool (p2Pool).

There is one project that has the potential to offer increase financialization of NFTs and traverse the p2peer design space that has constrained NFT liquidity thus far.

Enter NFTX

$NFTX has cleverly figured out a solution to offer p2pool liquidity to NFTs by allowing investors to wrap ERC-721 tokens into ERC-20 tokens and then package those underlying assets into a passive ERC-20 index fund. The pool, or index fund, has in, essence, increased the fungibility of NFTs -- and lest you need reminder, Non-Fungible-Tokens.

The protocol offers two funds to investors, D1 funds which are a 1:1 backing between a single NFT contract and an ERC20 contract, and D2 funds, which are Balancer pools which combine D1 funds.

The D1 funds can be thought of as traditional PE funds, and the D2 funds are funds-of-funds (FoFs).

Arbitraged

Let's take a peek into the design mechanics.

A fund manager deposits 3 punks into the fund, they receive the right to redeem any three punks in the fund at any point time. This incentivizes arbitrageurs to scour punks in p2peer markets if the floor price of the PUNK fund is trading above the price in the p2peer market.

On the opposite trade, if the PUNK fund is trading below the the price of an underlying punks, there would be little incentive to mint. In this instance, the user believes the punk is worth more than the floor price.

Moreover, should a valuable asset be included in the pooled fund, an arbitrageur, net of transaction cost and expect value analysis, could theoretically mint with a lower value asset and the redeem the higher value asset netting him / her the profit and leaving the fund worse off from a NAV perspective.

For pooled-assets that incessantly transmutate, a feature for some NFTs, such as AXIES, this remains a particular concern for the index investors and would likely dis-incentivize minting of NFTs.

Musings

This an inherent issue with NFTs. In other words, fungibility is what allows the p2pool contracts to work. Non-fungibility is what can start to stress the p2pool model.

Imagine a scenario where there are Class A Uniswap shares and Class B Uniswap shares, with A carrying 1 vote per token and B carrying 10 votes per token and preference for cash-flows. To pool these shares together and offer a 1:1 redemption rate wouldn't make sense given their large discrepancy. The LP pairs would of course be separated i.e UNI-A / WETH & UNI-B / WETH.

But this may not be such a pain-point for price sensitive users and rare NFTs. Remember, the goal is to offer investors increased access to liquidity.

Investors only need to know that they are receiving the floor price when they invest in the index. Should the market for PUNKs rise as a whole, they would be capturing the bottom tail of those assets, or in other words, they would be holding the lowest tranche of the asset-class.

This return might make sense for investors who cannot afford whole pieces of crypto-punks, but still strongly yearn for passive exposure to the asset-class.

Next Steps

So it seems, there are certainly stark challenges that the team and community must figure out.

Below are some ideas that I've been spit-balling with. (Again, I confess I'm quite new to the NFTX project so these implementations may have been written off already).

NFTX DAO specific-funds that send X number of D1 tokens when minted and require X number of D1 tokens when redeemed based on sub-set characteristic rarity through some sort of dynamic valuation model. This differs from the p2peer market because the smart-contract would quote a price based on inputs from respective oracle information and not by direct / real-time human judgement.

In this instance, NFTX would be acting more as an automated-asset-manager (AAM) than an automated-market-maker (AMM).

Offering NFT funds that alter the minting and redemption model. The current redemption model is known in the industry as a redemption in-kind, one where the investor receives the underlying asset. In a new model, investors would be able to redeem their D1 Tokens, not in the underlying NFT asset, but in ETH or USDC at a discount to the fund’s price.

This might be analogous to an derivative / options contract (if my financial product thinking is correct here). Let’s explore this a little more.

The NFT investor has three choices here:

1). Purchase the NFT outright at $100 at time X. At time Y, the fund is offering the investor a quoted price ($200) and a mint-and-redeem price of $190. The difference once again is due the liquidity premium. The investor ignores this believing that the current asset is greater than the fund floor price. The investor shops the NFT on the auction market and finds a counter-party to transact. However, at time Z, the auction-bids trend downward, and he finds a counter-party to take the NFT only at $150 whereas the fund is offering a quoted price of $125. The investor, fearful of another drawdown in price, takes the profit of $50 in a p2peer transaction.

2). Purchase the NFT outright at $100 at time X. At time Y, the fund is offering/quoting $200. At time Y, the investor believes the overall market is going to go through a massive drawdown of 50% given the recent euphoric state of the market. But they also believe the NFT is worth much more than $200, and believes the bid should be $300.

The investor has a decision to make: if the market tanks 50% as a whole, the (expected) price of the NFT asset would be $150. The investor would then net $50 at time Z.

On the other hand, if she mints, receives D1 tokens, and redeems at a discount ($190) to the fund’s quoted price of $200, she’ll net $90 in profit.

The investor redeems immediately. The market crashes 60% and stays there because the bull-run is over.

3). The investor can purchase the fund and sell freely. The downside is the fund is unlikely to capture high-quality NFTs that shrewd investors could capitalize on.

Determining the premium charged could be a little tricky. However, we know at least part of differential in redemption price quoted and the index price would represent the premium the investor pays for instant liquidity. The premium could be dynamic depending on market conditions i.e bid-ask spread on OpenSea, Gas prices, overall volatility in NFT markets, etc.

In any case, scenario two has enabled the investor be an active manager with a hard-cash liquidity back-stop in a volatile market. (Once the implied volatility of NFTs are figured out, NFTX may start to make more sense).

Beyond the minting and redeeming of existing NFTs, the platform could offer a one-stop shop to mint NFTs and fractionalize the ownership. This additional product offering would diversify the project should the index concept not reach adoption.

While high quality assets seemed to have achieved some form of PmF, there might be a future use-case for low quality assets as well. In the Web 3.0 world, there will be hundred-of-thousands of NFTs and a majority of these assets will commoditized despite their non-fungibility. Said differently, in a world with innumerable yet distinct digital assets, they can all look the same at some point. Nevertheless, there will still be some marginal price that investors are willing to pay (net of transaction cost). And that floor price can be determined by $NFTX. (However, for now, I believe the fund should focus on high quality assets).

Final Thoughts

I have to admit, I have an affinity for projects that can be true 0-to-1 innovations. And it's the reason why I hold this token; it's the first representation of pure-play DeFi technology meeting NFTs head on.

That said, the upside is counter-balanced by the nascent state of NFTX. There are also unexplored topics that I've yet to dig into, including the tokenomics, treasury, community hires, and the project's predilection for Ethereum long-term.

Ultimately, in a bull-market where opportunity cost is tremendously high, one must absolutely think about bet-sizing here.

Pour l'avenir de la France,

A.K

Financial Disclaimer: 3pointO strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.