What The Fork Is Going On?

An examination of modern power structures in mature smart-contract L1s

Intro

The first two sections are about defining loosely what sort of governance system exists in blockchains, and the second sections are about Ethereum’s upgrade to PoS. (Feel free to skip ahead).

Here’s a summary of each section, however.

The Tripartite System.

How the blocksize wars illustrated the tripartite in action.

Discuss the Merge and the new actors that have emerged.

Conclude and discuss the inevitability of this.

Evolving In Place

It’s been more than 10 years since Satoshi Nakamoto wrote the original Bitcoin white-paper. During the past decade or so, the market has molded the narrative in various functions and purposes; bitcoin has evolved from and intersected with payments, censorship resistant e-gold, reserve currency, inflation hedge, etc. And while this has certainly been a unique phenomena, I find the broader market has over-indexed on the narratives. Instead, they’ve failed to recognize the significance of the political theory that is so deeply embedded in the Bitcoin protocol, and moreover, the extraordinary ability to game-theoretically align various parties to cooperate in the system itself.

It is likely that Satoshi was greatly influenced by the US. This is because in both models, the US and Bitcoin, there are three separate powers that take complete ownership over a specific function. More importantly, however, while there is congruence, they still must ultimately check-and-balance each other during edge-cases so one function cannot reign supreme. In Bitcoin, the actors are functionally split into miners, developers, and nodes, and in the US, they are defined by the executive, legal, and judiciary branches. This sort of system is more formally known as the TriPartite.

Ultimately, it is worth asking whether political theory holds up in the practical world? Lobbyism, super-pacs, gerry-mandering, term-years, media, external actors, etc. are some of the leading stressors of the US tripartite. And this is not to say it has failed. Rather, it is to recognize what are the outcomes when institutional theory diverges and to ask if the system still is largely true to its nature, does it still have integrity?

Governance Trial

In retrospect, the core innovation of the Bitcoin protocol remains as a trial-run for the open-source tripartite. This was best illustrated in 2015 when a seemingly innocuous technical feature became lighter-fluid for a colossal governance stress-test. This epoch in crypto-history become known as the BlockSize Wars.

What’s important to recognize is how the system was working as designed, that the various branches of Bitcoin’s governance system were clashing and seeking consensus with each other. For instance, a number of prominent miners sought to increase the block-size limit almost unilaterally , but were effectively vetoed when core-developers did not merge the necessary code changes and economic nodes refused to propagate and validate their forked transactions. Some users / economic nodes purposely exerted negative price pressure through market actions. There were many other subtle and macro actions throughout the blocksize wars that illustrated what were soft-and-hard limitations of control that miners, nodes, and developers possessed. And this is what precisely would make Bitcoin more resilient, more antifragile as Taleb would argue; the market would realize there is a system fighting for the soul of Bitcoin instead of a centralizing actor

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure , risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.

However, where Bitcoin has succeeded has been in its sheer simplicity, which manifested in the communities unwillingness to make major changes to the protocol’s crypto-economic policies and reliance on technically-complex layer-2 solutions such as Lightning, other base-layer blockchains with smart-contract functionality emerged in place of them.

Enter Ethereum.

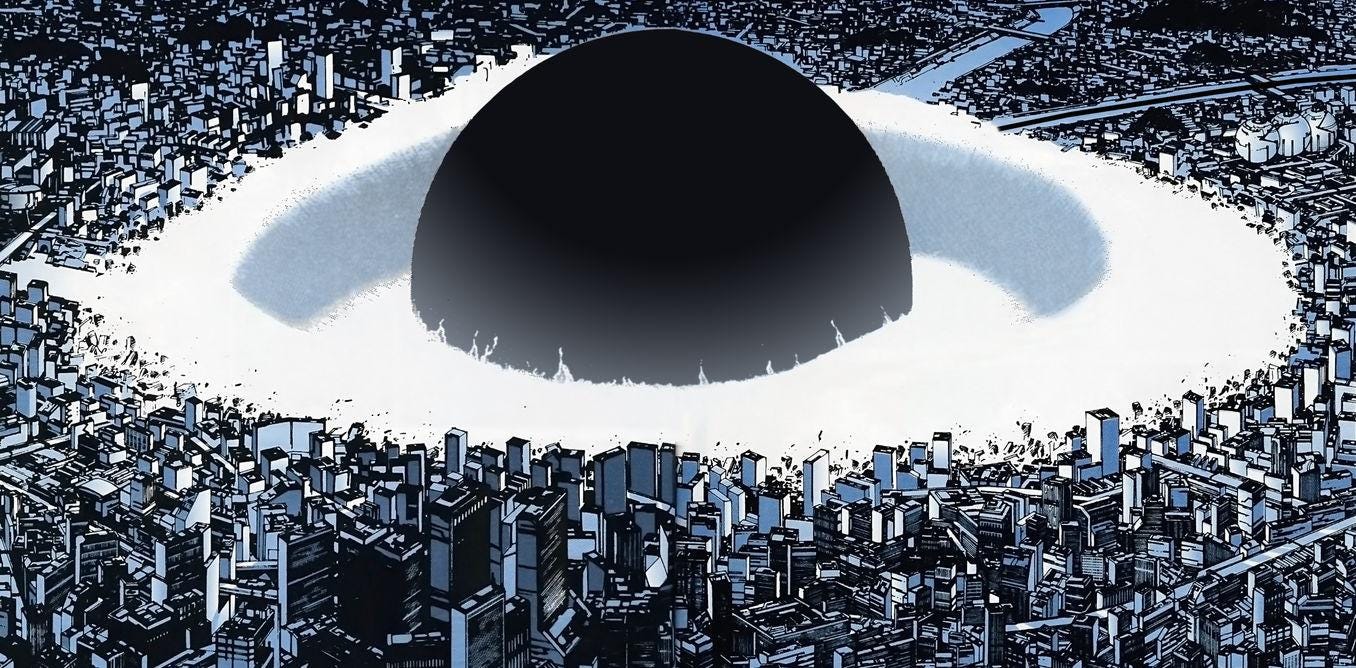

The Merge So Boring

A few weeks prior to Ethereum’s long awaited upgrade to PoS from Pow, known as the Merge, glimmers of contention started to emerge.

@GaloisCapital then polled the Ethereum community and ran them through a list of scenarios. It was (and still is) worth checking out the thread.

Miners and their related entities, made noise about the values of PoW. Given their large capital intensive operations and their loss of future operations, it's more than likely miners are motivated by financial exigency.

However, the merge was flawlessly executed and totally uneventful. Even in terms of price action, ETHW could barely mount meaningful market-share, and instead, ETH Classic continued to outperform other alt-coins. Of course, Ethereum PoS had earned a lot of social capital over the years, since PoS has been on its roadmap for some time. And yet, there is something worth examining here beyond the pros-and-cons of PoS vs. PoW.

Top-Heavy

In the legacy world of Bitcoin, it was miners, economic nodes, and developers who jostled for control at level playing field. However, it’s undeniable that Ethereum had undergone a quiet sort of revolution over the years, its power-structure becoming increasingly top-heavy. This is to say, modern structures were able to encroach upon the tripartite system inherited from Bitcoin’s design, and had tremendous influence on the path-dependency of Ethereum’s future.

Let’s examine.

Stablecoin issuers, such as Circle ($USDC) and Tether ($TUSD), exert the most control on the system. Collectively, these fiat infrastructure service providers account for approximately $100 billion in market capitalization, or approximately 10% of the total crypto-market-capitalization. So what exactly happened? First, Circle had pledged “sole” support of PoS Ethereum.

And second, while there was speculation that Paolo Ardoino of Tether was more in support of the PoW world, Ardino made the business decision to not cause instability in the already battered crypto market. What if there was broad end-user consensus to use PoW but Circle had chosen to solely support PoS? I believe given how much stablecoin infrastructure and stablecoin denominated leverage built into the DeFi system (i.e MakerDao, Aave, etc.), users would have no choice to side with Circle. And this is why Tether had to roll with Circle and PoS – its package deal.

Followed by Stablecoin Issuers, I believe centralized exchanges are the next modern power structure in the stack. And while exchanges were a force in the Bitcoin wars, I believe they have grown in influence. Simply said, they determine where end-users can on-ramp and off-ramp their crypto, distributing any prospective airdrops, and can forcefully choose to not make markets on their platform hence destroying liquidity and destroying any forks.

Next, without ChainLink, the largest provider of Oracle services, one cannot reasonably advance the state because a number of applications depend on off-chain data. Moreover, much of the value proposition of ChainLink resides in its network effects which further increases reliance on a single oracle service. This is because users who need the same information feed can cost-share the same oracle all while increasing the networks security budget (manifested in price of $LINK) in the form of fees. While there are other oracle providers, Chainlink has dominated the market for these reasons. And so, let us ask again, if ChainLink does not support PoW, would the application space survive? Yes, but it would not be without difficulty.

And lastly, while not exactly related, and certainly embedded in the Ethereum code-base since 2016, the difficulty bomb had simply nuked any % chance that ETH PoW would survive. The chain rapidly became unusable, which is why Ethereum Classic’s hash-rate and price action rocketed up.

With the combination of the above modern structures and difficulty bomb, it is no wonder why Ethereum merge was incredibly uneventful.

Conclusion

The more salient question, was this always inevitable? I believe so. Mature smart-contract blockchains cannot exist without large modern structures, i.e stablecoins, oracles, exchanges, wallets, market-places, etc. All of these entities will compete for users and consensus – power. And surely, this will erode the tripartite. The opposite of this however is Bitcoin, a closed, non-complex layer that has struggled to attract innovation and has confused the broader world with its multiple narratives. To me, Bitcoin remains a paper-perfect political innovation, a theoretical giant whereas Ethereum is where governance and pragmatism converge, where theory and reality meet.

Nevertheless, all blockchains will need to contend with these issues if they wish to find broad-based adoption.

Sources:

https://ryanthegentry.medium.com/a-theory-of-bitcoin-governance-

https://medium.com/@nic__carter/visions-of-bitcoin-4b7b7cbcd24c13510eff42a6